Back in the days before the 2007-8 financial crisis, one of the big sources of anxiety among (some of us) macroeconomists was the US current account deficit, a measure of how much the US was borrowing from the rest of the world each year.

After running deficits for most of the 1980s, an export boom helped bring the current account back into a small surplus in 1991 (aided, that year, by the financial assistance the US received from other countries to pay for the Gulf War). The deficit began to grow again in 1992, and in the mid-2000's seemed to be on an ever-increasing path.

US Current Account (% of GDP), 1980-2006

The flow of borrowing naturally generated an increasing net stock of debt - the United States' foreign liabilities exceeded its assets in 1986, and the net international investment position (assets minus liabilities) became increasingly negative during the 2000's.

Note that the change in the net international investment position doesn't exactly track the current account deficit because of changes in the values of assets.

And yet, while this data seemed to indicate that the US was on an unsustainable borrowing path - and perhaps facing the risk that the willingness of the rest of the world to lend to it could quickly evaporate in a "sudden stop" crisis, like a number of emerging market countries had experienced - the US continued to receive more in income from its foreign assets than it made in payments to foreign holders of US assets. That is, the income balance part of the current account remained positive.

US Net Income from Abroad, 1980-2006

How could the US consistently generate positive net income from its assets even as it became an increasingly large net debtor? Ricardo Hausmann and Federico Sturzenegger turned this question on its head - they argued that if the US was earning net income, it should not be considered a net debtor. In their account US foreign assets were under-estimated, with the official numbers leaving out what they dubbed "dark matter". In

a December, 2005 op-ed, they explained:

We propose a different way of describing the facts. We measure the

assets according to how much they earn and the current account by how much

these assets change over time. This is just like valuing a company by

calculating its earnings and multiplying by a price-earnings ratio. Of

course this opens up methodological questions, but the discrepancies with

official numbers are so big that the details do not matter. To keep things

simple in what follows we just take an arbitrary 5 per cent rate of return,

which implies a price-earnings ratio of 20.

Let's get to work. We know that the US net income on its financial

portfolio is $30bn. This is a 5 per cent return on an asset of $600bn. So

the US is a $600bn net creditor, not a $4,100bn net debtor. Since the assets

have remained stable then on average the US has not had a current account

deficit at all over the past 25 years. That is why it is still a net

creditor.

We call the $4,700bn difference between our measure of US net assets and

the standard numbers "dark matter", because it corresponds to assets that

generate revenue but cannot be seen.

This hypothesis generated a considerable amount of discussion, nicely summarized in

this Economist article from January 2006. Many economists were skeptical of such a blithe interpretation of the situation. One of the people quoted by the Economist was William Cline:

Mr Cline agrees with the dark materialists when they say there is

“something misleading about calling a country that makes money on its

financial position the world's largest debtor”. But sadly he does not

think Americans can stop worrying. After making $36.2 billion in 2004,

America made just $4 billion on its net foreign assets in the first

three quarters of 2005. If it continues on its present trajectory, it

will shell out about $190 billion in 2010, Mr Cline calculates. Using

Messrs Hausmann and Sturzenegger's methodology, America's net foreign

assets would then amount to minus $3.8 trillion. A dark matter indeed.

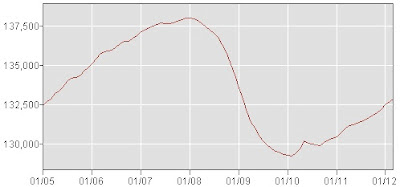

Seven years later, the US current account remains in deficit, though much less so:

US Current Account (% of GDP), 2001-2011

That is, the US is still borrowing from the rest of the world, but at a reduced pace. The value of the US' net foreign assets has been volatile as markets and currencies have gyrated over the past several years, but the official data says the US is even more in debt to the rest of the world now:

And yet, the balance of income on foreign assets is more in favor of the US now than ever before:

US Net Income from Abroad, 2001-2011

Repeating Hausmann and Sturzenegger's calculation today says that (as of the end of 2011) the US was a net creditor by $4540 billion. Relative to the official net international investment position of $4030 billion, that implies a stock of "dark matter" of $8570 billion!

Although the main source of "Dark Matter" in Hausmann and Sturzzenegger's original reckoning was the "know how" that helped US firms earn higher returns on Foreign Direct Investment (i.e., this was the main missing export), the most relevant for understanding what's happened since is probably the idea that the US exports "liquidity" and "insurance" services by selling assets that are considered safe and liquid by the rest of the world (e.g. US Treasury and "agency" - Fannie Mae and Freddie Mac bonds), while buying riskier assets.

The worry, circa 2005, was that buyers of US debt would run for the exit, leading to a spike in US interest rates and a collapse in the dollar. The crisis we actually got had the opposite effect, as everyone rushed into US debt, which has helped drive yields down. The US' net income is boosted by the fact that its paying very low returns on all those Treasuries being held abroad these days. In Hausmann and Sturzenegger's framework, the financial crisis has been a huge boon to US exports of (unmeasured) liquidity and insurance services.