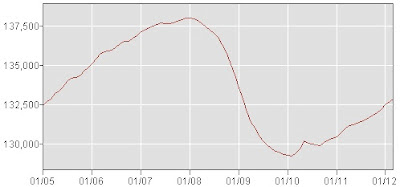

Unemployment Rate (Seasonally Adj., Source: BLS)

However, that was attributable to a decline in labor force participation, not job growth. The unemployment rate is calculated from a survey of households, and to be counted as unemployed someone must say that they are looking for work, so if people stop looking (i.e., they leave the labor force) that reduces the unemployment rate. In the household survey, the number of people reporting that they were employed actually decreased slightly (by 33,000), but the number of people in the labor force (i.e., working or looking for work) fell by 164,000.

Labor Force Participation Rate (Seasonally Adj.; Source: BLS)

The headline jobs number - nonfarm payroll employment - comes from a survey of businesses (it is considered more reliable because of a larger sample). That figure was a little better, but still unimpressive - a gain of 120,000 jobs, which is roughly consistent with a pace needed to keep up with population growth, but far short of enough to make a dent in unemployment.

Nonfarm Payroll Employment (Thousands, Seasonally Adj.; Source: BLS)

This report was a bit weaker than the past several months. Some have argued that the unusually warm weather in the winter may have provided a boost to hiring in those months, and if employers were bringing forward some of their hiring, it would also mean slightly less hiring than usual in the spring. This would mean the BLS' seasonal adjustment is slightly off. On a non-seasonally adjusted basis, nonfarm payrolls increased by 811,000 (but that's mostly due to the normal increase in this time of year so nothing to get excited about), and the unemployment rate rate fell from 8.7% to 8.4%.

Overall, this remains consistent with the view of an economy in a very slow recovery. Unemployment is still extremely high; about 12.7 million people are unemployed and many more are "discouraged workers" who have left the labor force or underemployed ("part time for economic reasons"). The BLS' broader measure that includes these people, "U-6," stands at 14.5%, which is down quite a bit from its peak, but still very high.

While the stronger reports over the past several months may have created a sense that the economy was picking up steam on its own, the March report may be a useful reminder that it could still use a push from policymakers. According Tim Duy's and Gavyn Davies' readings of the most recent Fed minutes, they appear inclined to hold off on further expansionary policy measures. Hopefully they will take today's report as an indication that such complacency is unwarranted (and Paul Krugman's critique of the Fed in his column today is timely).

No comments:

Post a Comment