The widely noted rightward shift of the Beveridge curve relationship can be interpreted as evidence of less efficient matching between employers and workers in the labor market

In the paper, I argue that less-efficient matching is related to the increased duration of unemployment spells seen during the last recession and its aftermath. There are several reasons why matching may be less efficient with a higher proportion of long-term unemployed:

- a loss of information as workers' informal networks may dry up over time

- a stigma associated with long-term unemployment (i.e., it acts as a negative signal)

- decreased search effort by long-term unemployed

The model includes a Diamond-Mortensen-Pissarides search-and-matching labor market framework, where hires (H) are a function of the number of vacancies (V) posted by firms and unemployed (U) workers

Hysteresis is modeled with the assumption that matching efficiency (A) is a decreasing function of the average duration of unemployment spells.

Rearranging the matching function to solve for efficiency (and setting alpha to 0.5), we can see that a decrease in efficiency coincides with the increase in the duration of unemployment spells

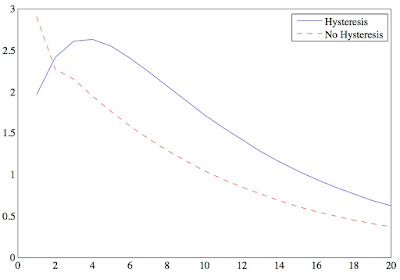

With hysteresis, the response of unemployment to a negative productivity shock is smaller initially but more persistent, as shown by the impulse response functions:

The reason for this is that, in the absence of hysteresis, firms can adjust their labor by sharply decreasing their vacancy posting. With hysteresis, the response of vacancies is less dramatic because firms take into account the fact that hiring will be more difficult in the future due to the decline in matching efficiency.

The model also considers demand shocks, which take the form of shocks to the discount factor, and monetary shocks (deviations from the Taylor rule), with similar results. Overall, hysteresis acts as a mechanism that increases the persistence of the response of macroeconomic variables to shocks. Since macro models struggle to generate endogenous persistence, this may be one of the main selling points of the paper.

Hysteresis also generates movements in the "natural rate" of unemployment, which I proxy by computing the amount of unemployment that would occur if wages and prices were flexible, taking as given the evolution of matching efficiency (A) from the baseline model. The green line shows the change in the natural rate in response to a negative productivity shock:

Note: this is a revised version of the draft circulated last fall as my "job market paper".

4 comments:

It seems the hysteresis you talk about could be the wasting of intangible capital assets. That is, extended unemployment causes loss of skills or failure to keep up with current practice. This is to say maintenance on labor's investment in their skills asset causes the investment to be lost. We should account for this investment, but we don't, do we?

It would seem therefore that hysteresis is imminently curable by proper maintenance. Which would also say it's not really hysteresis, is it, if you can indeed get back to where you started from?

john

John, thanks for the comment. That's an interesting way of thinking about it. If we take the "human capital" story seriously, then it would be natural to ask whether (and how well) people can maintain their human capital independently of work experience (i.e., "learning by doing").

In general, the setup of the model implies that you eventually get back to equilibrium, hysteresis just makes that process slower. I.e., the interpretation of "hysteresis" is as a mechanism for making the effects of shocks longer-lasting, but still not permanent. In my case, to be honest, that's partly dictated by the modelling technology, though I think its arguably appropriate for the US case; for Europe, Jordi Gali (NBER Working Paper 21430) implements hysteresis as a mechanism for permanent effects of shocks.

Wow, Bill, great reading on your part to figure out what I fumbled to say, leaving out a couple words in haste.

"Skills" are just one example. Probably more important and larger are the networks of relationships people and businesses invest in building. In ordinary times these networks throw off new business and new jobs, but in recession, that yield drops, spending to maintain contacts or contracts, marketing or development to create new ones, all decline, and the networks waste. The firmest of these networks are the customer and supplier relationships of businesses. We do not record these as capital, though they do yield, and businesses invest heavily in creating them, usually recorded as expense rather than investment.

I think you're using hysteresis as an explanation of slow recovery. To me it's a failure of investment to maintain all capital assets, a failure of government to fund demand replacement to keep these assets "fed". To me hysteresis in this case is (like secular stagnation) a description of a result, not a cause. The cause is the failure to act. And acting at a low level or a high level can lead to low and high equilibria. To a guy watching businesses rather than doing models, this seems obvious.

Secular stagnation in particular sure looks like an effort to move the target to where the arrow is going.

john

Thanks. Yes, I think relationships can be thought of has having a capital-like component. Although I think decay of informal networks may be an important element - and Bernanke mentioned it in a quote I used in the paper - I haven't come across good empirical research on it.

Overall, I'd agree that this suggests a need for greater policy urgency, and perhaps a willingness to tolerate overshooting an inflation target to reverse the process.

Post a Comment