At wonkblog, Matt O'Brien writes:

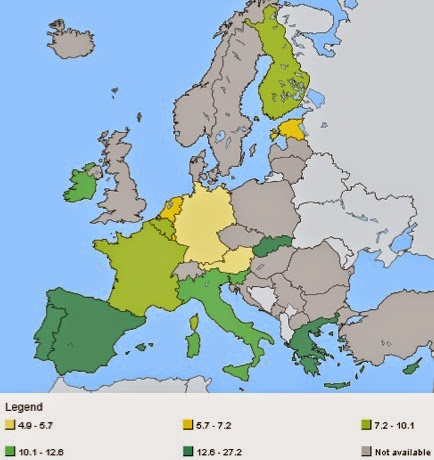

As I've said before, the euro is the gold standard with moral authority. And that last part is the problem. Europeans don't think the euro represents civilization, but rather the defense of it. It's a paper monument to peace and prosperity that's made the latter impossible. So the eurocrats who have spent their lives building it are never going to tear it down, despite the fact that, as it's currently constructed, the euro is standing between them and recovery.Unemployment rates are above 20% in Spain and Greece, and above 10% in Portugal, Italy, Ireland, France, Cyprus, Slovakia and Slovenia:

Just like the 1930s, Europe is stuck with a fixed exchange system that doesn't let them print, spend, or devalue their way out of a crisis. But, unlike then, Europe might never give it up. It's a fidelity to failure that even the gold bloc couldn't have imagined.

Ambrose Evans-Pritchard spoke to several economics Nobel laureates:

It may be a slightly hopeful sign that Francois Hollande is coming to a recognition of the problem, the Times' Liz Alderman reports:An array of Nobel economists have launched a blistering attack on the eurozone's economic strategy, warning that contractionary policies risk years of depression and a fresh eruption of the debt crisis."Historians are going to tar and feather Europe's central bankers," said Professor Peter Diamond, the world's leading expert on unemployment. "Young people in Spain and Italy who hit the job market in this recession are going to be affected for decades. It is a terrible outcome, and it is surprising how little uproar there has been over policies that are so stunningly destructive," he told The Telegraph at a gathering of Nobel laureates at Lake Constance...

Professor Joseph Stiglitz said austerity policies had been a "disastrous failure" and are directly responsible for the failed recovery over the first half of this year, with Italy falling into a triple-dip recession, France registering zero growth and even Germany contracting in the second quarter.

"There is a risk of a depression lasting years, leaving even Japan's Lost Decade in the shade. The eurozone economy is 20pc below its trend growth rate," he said...

Professor Christopher Sims, a US expert on monetary policy, said EMU policy makers had not sorted out the basic design flaws in monetary union, and are driving Club Med nations into deeper trouble by imposing pro-cyclical austerity.

"If I were advising Greece, Portugal or even Spain, I would tell them to prepare contingency plans to leave the euro. There is no point being in EMU if all that happens when you are hit with a shock is that the shock gets worse," he said.

"It would be very costly to leave the euro, a form of default, but staying in the euro is also very costly for these countries. The Europeans have created a system that is worse than the Gold Standard. Countries are in the same position as Latin American states that borrowed in dollars," he said.

After months of insisting that a recovery from Europe’s long debt crisis was at hand, President François Hollande on Wednesday delivered a far bleaker message. He indicated that the austerity policies France had been compelled to adopt to meet the eurozone’s budget deficit targets were making growth impossible.Paris officials say that France — the eurozone’s second-largest economy after Germany — will no longer try to meet this year’s deficit-reduction targets, to avoid making economic matters worse. Even in abandoning those targets, they indicated that France was unlikely to recover soon from its long period of stagnation or quickly reduce its unemployment rate, which exceeds 10 percent.“The diagnosis is clear,” Mr. Hollande said in an interview published Wednesday in the French daily Le Monde. “Due to the austerity policies of the last several years, there is a problem of demand throughout Europe, and a growth rate that is not reducing employment.”

To really make a difference, though, a more inflationary monetary policy is needed, and there is no sign of that on the horizon.

A euro breakup in 2010, 11 or 12 would have been disastrous for sure, but I'm beginning to wonder if it would have been worse than what we've actually seen.

No comments:

Post a Comment