two dates are marked with vertical lines: the the Brexit vote (red line) and the Prime Minister's speech signalling that the most likely outcome was a "hard Brexit" (green line) where the UK leaves the European single market (i.e., that it won't become part of the European Economic Area, like

Departure from the EU and the single market make the UK a less attractive location for foreign investment (see, e.g., comments from Nissan's CEO about its Sunderland plant). A decrease in demand for UK assets implies a drop in the pound. The UK is also a less attractive location for domestic investment now as well, and the situation is probably not a good one for consumer confidence - a reduction in demand due to lower desired consumption and investment would imply lower interest rates, which also would cause the pound to fall.

Is this yet another "sterling crisis"? Not in the usual sense - as Gavyn Davies notes, there is no fixed exchange rate to defend this time, and most of the UK's external debt is denominated in pounds.

As Paul Krugman explains, a fall in the pound is a part of the adjustment process. He writes:

But it’s important to be aware that not everyone in Britain is equally affected. Pre-Brexit, Britain was obviously experiencing a version of the so-called Dutch disease. In its traditional form, this referred to the way natural resource exports crowd out manufacturing by keeping the currency strong. In the UK case, the City’s financial exports play the same role. So their weakening helps British manufacturing – and, maybe, the incomes of people who live far from the City and still depend directly or indirectly on manufacturing for their incomes.However, a rebalancing of the UK economy in favor of manufacturing exports will not come quickly, according to Barry Eichengreen (Robert Skidelsky goes further and argues for helping the process along through "import substitution" policies).

One likely consequence is inflation, as Ambrose Evans-Pritchard writes. Prices of imported goods will rise significantly (though the process of "exchange rate pass-through" generally occurs with a lag - the "marmite row" may have been a harbinger of things to come). The inflation will hit lower-income families especially hard, according to Evans-Pritchard's column, because the government has frozen some benefit payments, so inflation will cause their real value to fall.

Rising costs for imports don't only impact consumers - they also affect producers. On the one hand, domestic producers benefit from increases in the relative prices of imported substitutes. On the other - and this is becoming more and more relevant in an age of global supply chains - prices of imported inputs (intermediate goods) will rise, increasing production costs.

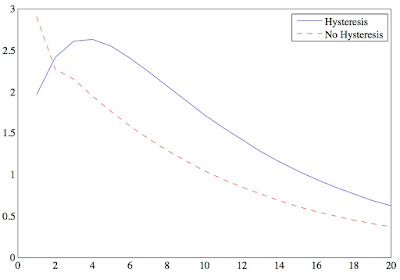

With the rise in cost of intermediate inputs and the greater costs of selling to its main trading partners, the impact of Brexit looks like a negative supply shock. Supply shocks create a nasty dilemma for monetary policy. Policy can "accommodate" the shock by allowing inflation to rise - doing so minimizes the increase in unemployment and helps keep output near its (diminished) potential. Or the Bank of England could tighten policy to keep inflation in check, with negative consequences for output and employment.

The risk with accommodation is not just inflation itself, but a potential increase in inflation expectations and loss of the central bank's credibility. Part of the standard interpretation of 1970's stagflation is that the Fed was too accommodating after the 1973 oil shock, and which contributed to inflation expectations getting out of control.

The Bank of England has a formal 2% inflation target; right now inflation is running below target, but that will change.

I personally think its to Bank of England's credit that it's allowed inflation go above target at a couple of points during the turmoil of recent years. If their policy is credible, an occasional miss doesn't cause inflation expectations to rise. But the point of inflation targeting is to achieve credibility by meeting a stated target, so the BofE may be putting that at risk if it's always seen to be accommodating shocks.

*corrected 10/26